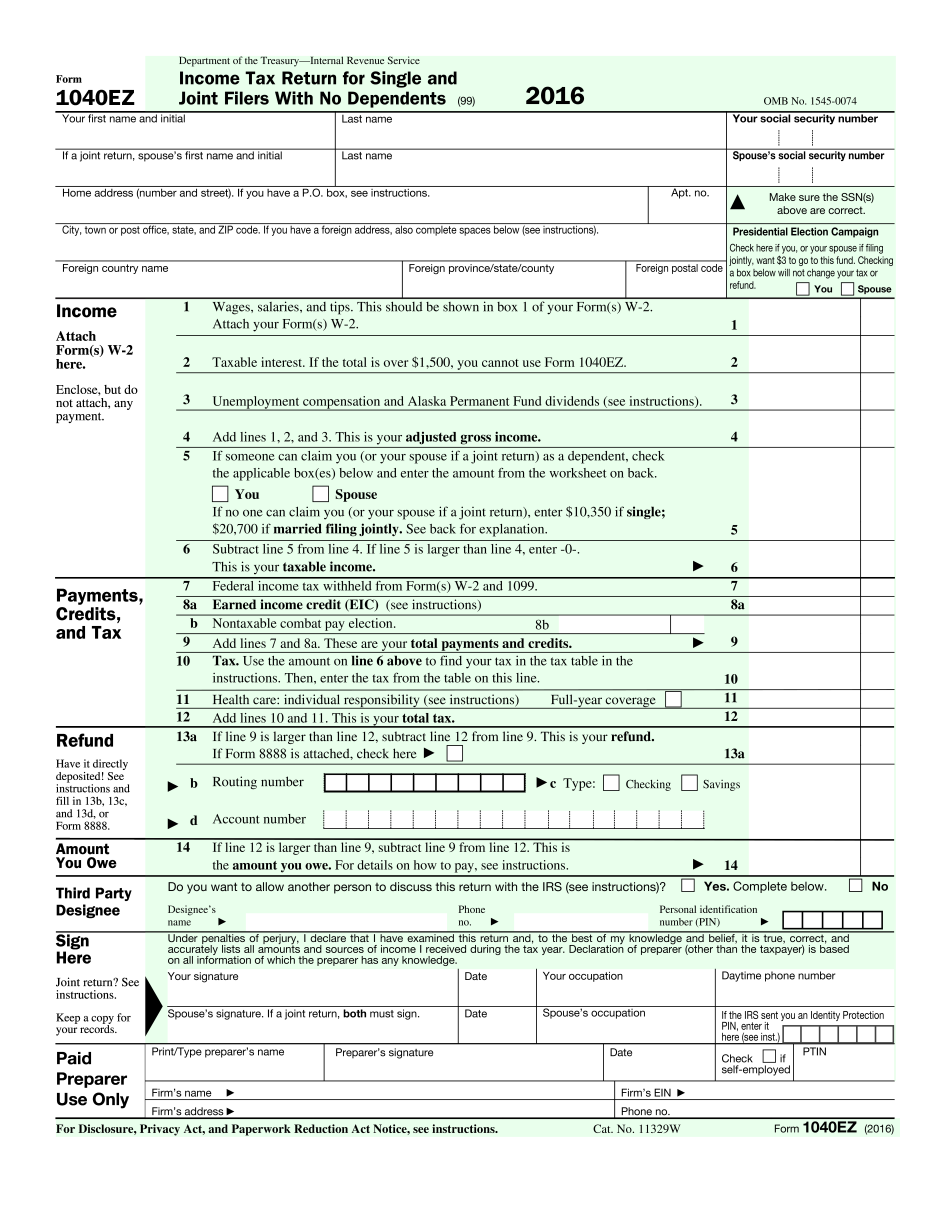

Okay in this video we're going to talk about how to fill out a 1040 EZ federal tax form now the reason we're only focusing on a 1040 EZ it's because this is the most common form that you will ever fill out when doing your taxes now let's go and get started what you're going to need is a w-2 a 1040ez form as well as the tax table now I'm going to provide all of that on the on this video here so if you have one of my worksheets or if you have something else that you can go along with and feel free let's go and get start all right step 1 use the W — now the w2 it looks like this is the form that you get every year from your employer all right it tells you how much money you make how much money you have paid in taxes state federal all that it's basically a snapshot or a progress report if you will of how much money you've made financially for your know for your for job for your job so the first thing I want to look at is how much money did you make so how much money you made was right here on the first line seventy-six thousand three hundred and fifty now going to my 1040 EZ that's what I'm going to put here seventy-six thousand, and I just forgot exactly how much it was 350 so seventy-six thousand three hundred and fifty okay now for this particular example and the ones that we're going to do in this class lines two and three it talks about taxable interest meaning if you got money off of maybe a savings account or something or step or line three is...

Award-winning PDF software

How to prepare IRS 1040-EZ 2025 Form

About IRS 1040-EZ 2025 Form

The IRS 1040-EZ 2025 Form is a simplified version of the individual income tax return form provided by the Internal Revenue Service (IRS) in the United States. It is specifically designed for taxpayers who have straightforward tax situations, enabling them to file their taxes quickly and easily. To qualify for using the 1040-EZ form, taxpayers must meet several criteria, including having a filing status of single or married filing jointly, no dependents, and a taxable income below $100,000. Additionally, only certain types of income and deductions are allowed on this form. The 1040-EZ form is ideal for individuals with uncomplicated tax situations, such as those who have basic wage or salary income, limited interest income, and no significant adjustments to income or deductions to claim. It is not suitable for individuals with complex financial circumstances, such as those who have self-employment income, investment income, rental income, or itemized deductions. Using the 1040-EZ form eliminates the need for extra calculations and reduces the amount of required documentation. This simplified form facilitates faster processing and quicker refunds for eligible taxpayers.

Online options help you to organize your own file operations and also increase the productivity of the workflow. Keep to the fast information to do IRS 1040-EZ 2025 1040ez 2025 Forms, stay away from errors as well as supply this on time:

How to perform a IRS 1040-EZ 2025 1040ez 2025 Forms on the web:

- On the web site using the form, click on Start Now and move on the publisher.

- Use the particular signs to be able to submit the appropriate career fields.

- Add your own data and phone data.

- Make sure one enters correct details and amounts inside appropriate career fields.

- Wisely look into the written content with the file and also sentence structure as well as punctuation.

- Refer to Assistance area if you have any questions or address the Assist crew.

- Put a digital signature on the IRS 1040-EZ 2025 1040ez 2025 Forms by making use of Sign Instrument.

- After the design is finished, press Carried out.

- Send the actual set document by way of electronic mail or facsimile, print it out as well as safe money on your gadget.

PDF manager enables you to help make alterations in your IRS 1040-EZ 2025 1040ez 2025 Forms through the World Wide Web connected device, customize it in accordance with your preferences, signal it electronically and also distribute diversely.

What people say about us

Submitting forms online saves your time

Video instructions and help with filling out and completing IRS 1040-EZ 2025 Form